Predicting Generic Entry: How to Forecast When Your Drug Will Face Generic Competition

Jan, 22 2026

Jan, 22 2026

When a brand-name drug’s patent runs out, the market doesn’t just change-it collapses. Prices drop by 80% or more. Revenue vanishes overnight. And if you’re not ready, your business takes a hit no budget can fix. The key isn’t just knowing when the patent expires. It’s knowing when generics will actually hit the shelves-and how many will come, and how fast prices will fall. This isn’t guesswork. It’s a science built on patents, FDA data, lawsuits, and market behavior.

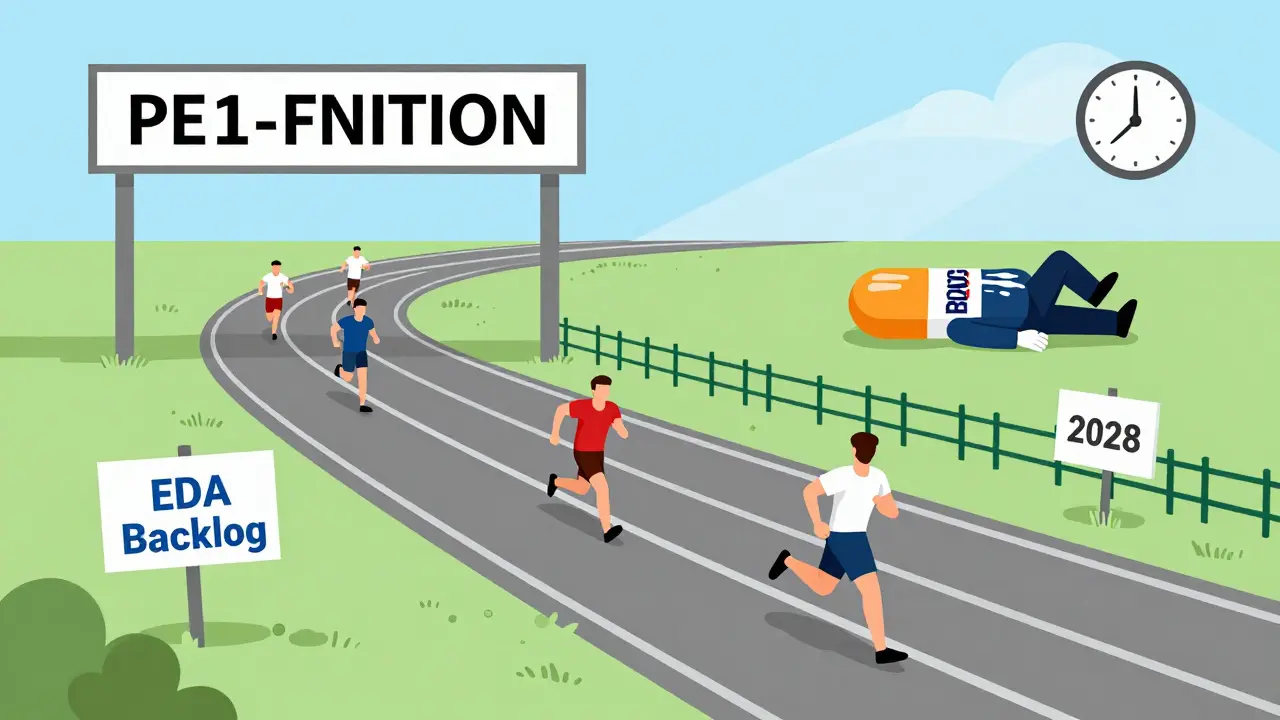

Why Patent Expiration Dates Alone Are Useless

Most people think: Patent expires in June 2026? Generics will launch in July. That’s wrong. And it’s expensive. The patent expiration date is just the starting line. The real race starts there-and it’s full of detours. Take Humira. Its core patent expired in 2016. But generics didn’t arrive until 2023. Why? Because the company filed over 130 patents on minor changes-dosage, delivery, packaging. Each one delayed competitors. That’s called “evergreening.” And it’s not rare. In 63% of top-selling drugs, companies use tactics like this to stretch exclusivity by 18 to 24 months. Even if no lawsuits happen, the FDA doesn’t approve generics on a whim. It takes an average of 38 months from the time a generic company submits its application (called an ANDA) to when it gets approved. That’s over three years. So if a patent expires in 2027, and no one files an ANDA until 2025, you’re looking at 2028 before generics appear.The Real Timeline: What Actually Controls Generic Entry

There are five real drivers that determine when generics arrive:- Patent litigation - If a generic company files a Paragraph IV certification (saying they believe the patent is invalid or won’t be infringed), the brand company has 45 days to sue. That automatically delays approval by up to 30 months. About 42% of cases result in delays of 18.7 months on average.

- Regulatory exclusivity - Even after a patent expires, the FDA may grant extra protection. Pediatric exclusivity adds 6 months. New Chemical Entity (NCE) status gives 5 years. These are separate from patents and often overlooked.

- ANDA approval speed - The FDA’s backlog matters. Between 2021 and 2022, pandemic staffing cuts added 7.2 months to approval times. Even now, approval timelines vary wildly by drug type. Inhalers and topical products take 52 months on average. Standard pills? 38 months.

- First-filer exclusivity - The first company to file a Paragraph IV ANDA gets 180 days of exclusive rights to sell the generic. That’s a huge incentive. So if you see a Paragraph IV filing, expect the first generic within 12 to 18 months after litigation ends.

- Market size - Drugs making over $1 billion a year attract more challengers. They’re worth the legal and development cost. Smaller drugs? Often no one bothers.

How Forecasting Models Work (And Why Most Are Wrong)

There are two kinds of models: simple and smart. Simple models use patent dates and market size. They’re easy. They’re cheap. And they’re wrong 50% of the time. Their R² value-how well they predict timing-is only 0.42 to 0.51. That’s barely better than flipping a coin. Smart models use 40+ data points. They track:- Every patent listed in the FDA Orange Book

- Every Paragraph IV certification

- Every lawsuit outcome

- Previous ANDA approval times for similar drugs

- Therapeutic equivalence codes (TE codes)

- State substitution laws

- Rems programs (risk evaluation and mitigation strategies)

What Happens After the First Generic Arrives

The first generic doesn’t just lower prices-it starts a chain reaction.- First generic: Prices drop 39% below brand

- Second generic: Prices fall another 15%, hitting 54% below brand

- Sixth generic: Prices are 85% lower than the original

Who Uses This Info-and How

Two groups live by these forecasts: Brand companies use them to plan. They need to know when to cut R&D spending, when to launch new versions, when to negotiate with payers, and when to shift marketing budgets. One top pharma company told an industry forum that their simple model overestimated generic entry by 11.4 months. That mistake cost them $220 million in lost revenue on a single $1.2 billion drug. Generic manufacturers use them to pick their battles. Why spend $50 million developing a drug if three other companies are already filing ANDAs? Why risk a lawsuit if the patent is rock-solid? The best generic companies use platforms like Drug Patent Watch to analyze litigation history, bioequivalence failure rates, and even the quality of past ANDA submissions. One exec saved $15 million by avoiding two failed submissions after spotting bioequivalence red flags early.What You Can Do Right Now

You don’t need a $1 million software license to start forecasting. Here’s how to begin:- Check the FDA Orange Book - Search your drug. Look at every listed patent. Note expiration dates and exclusivity periods.

- Search for Paragraph IV certifications - These are filed with the FDA and publicly available. If you see one, expect a lawsuit and a delay.

- Track ANDA status - The FDA publishes a weekly list of pending ANDAs. If a generic is under review, approval is likely within 6-12 months.

- Look for citizen petitions - If a brand company files one asking the FDA to block a generic, expect a 7-month delay.

- Monitor state substitution laws - California, New York, and Texas have stricter rules. Generics may enter faster in some states, slower in others.

The Future: AI Is Changing the Game

By 2026, AI models will cut prediction errors in half. They’ll scan thousands of patent filings, court documents, and FDA letters to spot patterns humans miss. They’ll learn from past failures-like why a certain bioequivalence test keeps failing for a class of drugs. But even AI can’t predict human behavior. Like when a company quietly shifts patients to a new version before the patent expires. Or when a payor suddenly decides to block generic substitution. Or when a new law-like the Inflation Reduction Act’s Medicare price negotiation rules-changes the whole game. The truth? Forecasting generic entry isn’t about being 100% right. It’s about being right enough to act. To protect revenue. To plan R&D. To avoid being blindsided.Frequently Asked Questions

How do I find out if a generic drug is coming soon?

Check the FDA’s Orange Book for patent expirations and Paragraph IV certifications. Then search the FDA’s ANDA application list. If a generic company has submitted an application and there’s no active litigation, approval is likely within 12 to 18 months. You can also use free tools like DrugPatentWatch’s public tracker or the FDA’s Drug Approvals and Databases portal.

Why do some drugs get generics quickly and others don’t?

Three things matter: market size, complexity, and legal barriers. Drugs making over $1 billion a year attract more challengers. Simple pills are easier to copy than inhalers or injectables. And if the brand company has filed many patents or is fighting lawsuits, generics get delayed. Biologics take even longer because they’re harder to replicate and face stricter FDA rules.

Can a brand company stop generics from entering the market?

Not permanently, but they can delay them. Through patent litigation, citizen petitions, product hopping (switching patients to a new version), or even launching their own authorized generic. These tactics can push back entry by months or years. But once patents expire and exclusivity ends, generics will enter-eventually.

What’s the difference between a generic and a biosimilar?

Generics are exact copies of small-molecule drugs (pills, capsules). Biosimilars are similar but not identical to complex biologic drugs (injectables, antibodies). They’re harder to make, cost more to develop, and face stricter approval rules. As a result, biosimilars take longer to enter the market and don’t drive prices down as fast.

How accurate are commercial forecasting tools?

The best tools-like Evaluate Pharma, IQVIA, and Drug Patent Watch-are accurate within 6 to 8 months for small-molecule drugs. Simpler tools using only patent dates are only accurate within 12 to 18 months. Accuracy drops for complex drugs, biologics, and cases with heavy litigation. Most tools fail to predict authorized generics and state-level substitution rules.

Is it worth investing in a forecasting system?

If you manage a drug with over $500 million in annual revenue, yes. The average enterprise system costs $250,000 to $1.2 million per year. But the cost of missing a generic entry by 12 months on a $1 billion drug can be $300 million or more. Most top pharma companies use multiple models because the ROI is clear.

Dolores Rider

January 22, 2026 AT 19:25venkatesh karumanchi

January 23, 2026 AT 17:52Jenna Allison

January 25, 2026 AT 10:37Vatsal Patel

January 26, 2026 AT 19:00Sharon Biggins

January 27, 2026 AT 02:58John McGuirk

January 27, 2026 AT 12:32Michael Camilleri

January 27, 2026 AT 15:01Kat Peterson

January 29, 2026 AT 13:10Husain Atther

January 29, 2026 AT 19:35Helen Leite

January 31, 2026 AT 09:05Phil Maxwell

January 31, 2026 AT 18:35Sushrita Chakraborty

February 1, 2026 AT 12:48Josh McEvoy

February 3, 2026 AT 12:24Sawyer Vitela

February 3, 2026 AT 23:46