Out-of-Pocket Costs: What Patients Pay for Generics vs Brand-Name Drugs

Dec, 31 2025

Dec, 31 2025

When you pick up a prescription, the price on the receipt can feel random. One pill costs $3, another $120-even if they’re supposed to do the same thing. The difference? Generics and brand-name drugs. Most people assume generics are cheaper, and they’re right-most of the time. But the real story isn’t just about price tags. It’s about how your insurance plan, pharmacy choices, and hidden rules in Medicare can flip the script and make you pay more for a generic than a brand.

Generics aren’t cheap copies-they’re the same medicine

The FDA doesn’t let drug companies slap a "generic" label on just anything. To be approved, a generic must have the same active ingredient, strength, dosage form, and route of administration as the brand-name version. It must also prove it works the same way in your body. That’s called bioequivalence. No shortcuts. No "weaker" versions. So why the big price gap? It’s not about quality. It’s about money. Brand-name companies spend years and hundreds of millions developing a drug, patenting it, and marketing it. Once that patent expires, other manufacturers can make the same drug without those upfront costs. That’s why generics typically cost 80 to 85% less than the original. In the U.S., nine out of every ten prescriptions filled are for generics. But here’s the twist: even though they’re used so often, generics only make up about 18% of total prescription spending. That’s because the few brand-name drugs still on the market-especially new, high-cost ones-are so expensive they drag the average way up.Insurance plans hide the real cost

Your out-of-pocket cost isn’t just the pharmacy’s sticker price. It’s shaped by your insurance design. Two people with the same drug, same plan, same pharmacy-can pay wildly different amounts. If your plan has a flat copay-say, $10 for generics and $40 for brands-you won’t feel the price hikes. Even if the brand-name drug jumps from $200 to $250, your $40 stays the same. That’s because your insurer absorbs the increase through rebates from the drugmaker. But if your plan uses coinsurance-like 25% of the drug’s price-you’re on the hook for every dollar the list price rises. In one 2021 study, list prices for brand-name drugs rose 16.7% over two years. Patients with coinsurance paid more. Those with copays? Nothing changed. And then there’s the deductible. If you haven’t met your annual deductible, you pay the full negotiated price-sometimes hundreds of dollars-for a single generic. That’s why some people skip doses or split pills. It’s not laziness. It’s economics.The Medicare Part D trap

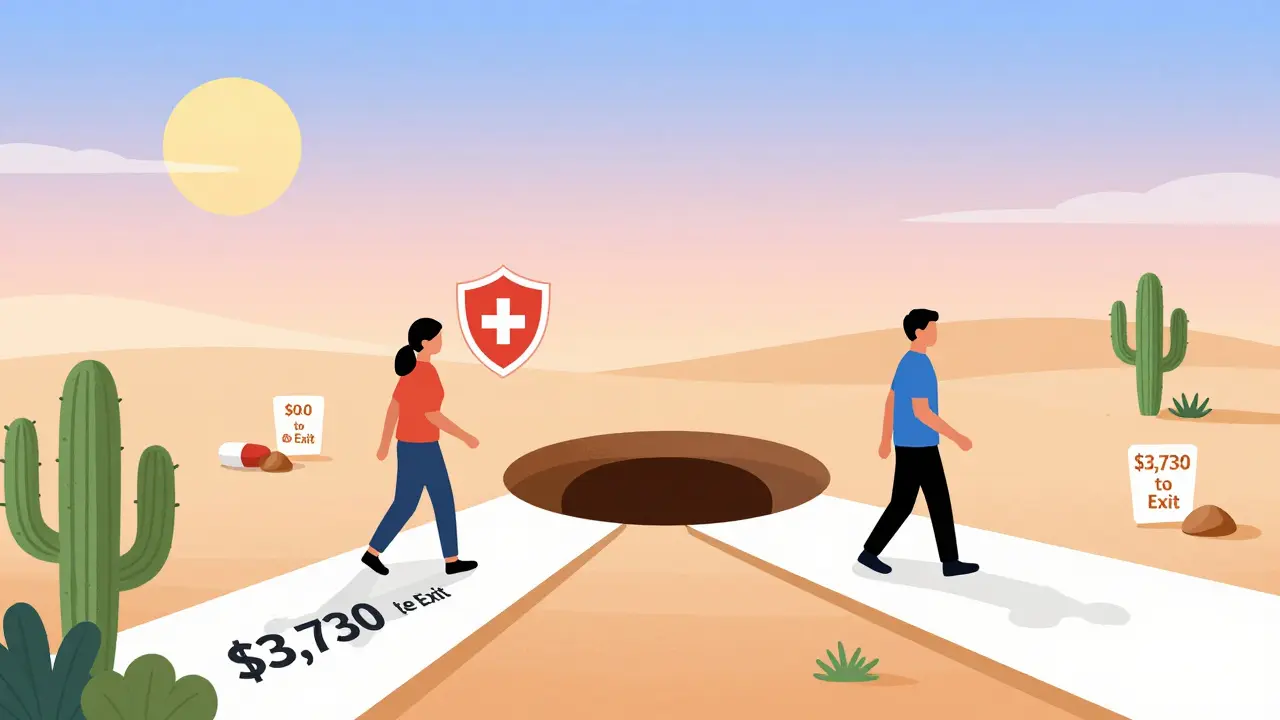

Medicare Part D is where things get bizarre. The program has a coverage gap-called the "donut hole"-where you pay more after hitting a certain spending threshold. Here’s the kicker: brand-name drug manufacturers are required to give discounts in the donut hole. Those discounts count toward your out-of-pocket spending. Generics? No discounts. No help. In 2019, a patient on a brand-name drug needed to spend $982 to get out of the donut hole. A patient on a generic? They had to spend $3,730. That’s 279% more. Why? Because the system rewards the brand-name companies for helping patients reach catastrophic coverage faster. Generic makers don’t get that deal. So even though the generic pill costs less, the rules make you pay more to get the same protection. This isn’t theoretical. In 2020, Medicare raised the out-of-pocket spending threshold for catastrophic coverage from $5,100 to $6,350. That made the gap even wider. And while Congress is now talking about capping out-of-pocket costs, the current structure still punishes people who rely on generics.

When generics cost more than brands

It sounds impossible, but it happens. Some specialty generics-like those used for rare conditions or complex treatments-can be priced higher than their brand-name equivalents. Why? Because there’s little competition. If only one or two companies make the generic, they can set prices high. And if your insurance plan doesn’t cover them well, you’re stuck paying the full cost. One study found that for 11.8% of generic prescriptions, patients saved money by paying cash instead of using insurance. The median savings? Just under $5 per prescription. That doesn’t sound like much-but if you’re taking five generics a month, that’s $25 saved. For uninsured patients, that’s life-changing. For Medicaid patients? No savings. The system doesn’t allow it.How to pay less: cash, transparency, and smart choices

You don’t have to accept whatever your pharmacy charges. Here’s what works:- Ask for cash prices. Many pharmacies, like Mark Cuban Cost Plus Drug Company or Blueberry Pharmacy, sell generics at transparent, low prices. You pay cash. No insurance. No middlemen. For some drugs, this saves 30-70%. In 2020, 97% of cash payments at these pharmacies were for generics.

- Use GoodRx or similar apps. These tools show you the lowest cash price in your area. Sometimes it’s cheaper than your insurance copay.

- Ask your doctor to write "dispense as written". If your doctor thinks the brand is essential, they can block substitution. But if they don’t, the pharmacist can switch you to the generic-unless you say no.

- Check if your drug is on a preferred list. Insurance plans have tiered formularies. A Tier 1 generic might cost $5. A Tier 3 could be $45. Ask your plan for the list.

Why the system is broken-and who pays

The real problem isn’t that generics are expensive. It’s that the system rewards complexity over fairness. Pharmacy Benefit Managers (PBMs), insurers, and drugmakers negotiate rebates behind closed doors. Those rebates lower the overall cost-but rarely reach you. In fact, the Schaeffer Center at USC found patients may be overpaying for generics by 13-20% because of middlemen profits and lack of price transparency. Meanwhile, the cost of brand-name drugs keeps rising. Median list price increases over two years? 16.7%. That’s faster than inflation. And while manufacturers give rebates to insurers, those savings don’t trickle down to patients. The system is designed to protect profits, not people. But here’s the good news: you’re not powerless. You can choose where you buy your meds. You can ask for cash prices. You can question why a $2 generic costs you $40. You can demand transparency.What you can do today

- When you get a new prescription, ask: "Is there a generic?" If yes, ask: "What’s the cash price?"

- Compare the cash price to your insurance copay. Use GoodRx or a similar app.

- If you’re on Medicare Part D, check your plan’s formulary and donut hole rules. Ask your pharmacist to explain your out-of-pocket costs.

- Don’t assume generics are always cheaper. Some specialty ones aren’t.

- If your doctor insists on a brand, ask why. Is it medical necessity-or habit?

It’s not about being a savvy shopper. It’s about knowing your rights. Your health shouldn’t depend on how well you navigate a broken system. But until that system changes, knowing how to play it can save you hundreds-or even thousands-each year.

Joy Nickles

December 31, 2025 AT 16:06Emma Hooper

January 1, 2026 AT 23:52Martin Viau

January 3, 2026 AT 22:28Marilyn Ferrera

January 5, 2026 AT 04:21Robb Rice

January 6, 2026 AT 02:02Harriet Hollingsworth

January 7, 2026 AT 22:45Sara Stinnett

January 9, 2026 AT 15:23linda permata sari

January 9, 2026 AT 16:52Brandon Boyd

January 10, 2026 AT 03:00Paul Huppert

January 10, 2026 AT 14:34Hanna Spittel

January 12, 2026 AT 06:43Kayla Kliphardt

January 13, 2026 AT 20:29John Chapman

January 14, 2026 AT 11:43Urvi Patel

January 15, 2026 AT 21:38Deepika D

January 17, 2026 AT 09:56