Managing Formulary Changes: How to Handle Prescription Drug Coverage Updates

Jan, 27 2026

Jan, 27 2026

When your insurance plan suddenly stops covering your medication, it’s not just a paperwork issue - it’s a health crisis. You’ve been taking your drug for years. Your condition is stable. Then, out of nowhere, your monthly cost jumps from $40 to $500. You didn’t get a letter. Or if you did, it was buried in a stack of statements. This isn’t rare. In 2024, formulary changes affected over 1 in 3 Medicare beneficiaries and nearly half of commercially insured patients. The system isn’t broken - it’s complex. And if you don’t know how to navigate it, you risk your health.

What Exactly Is a Formulary?

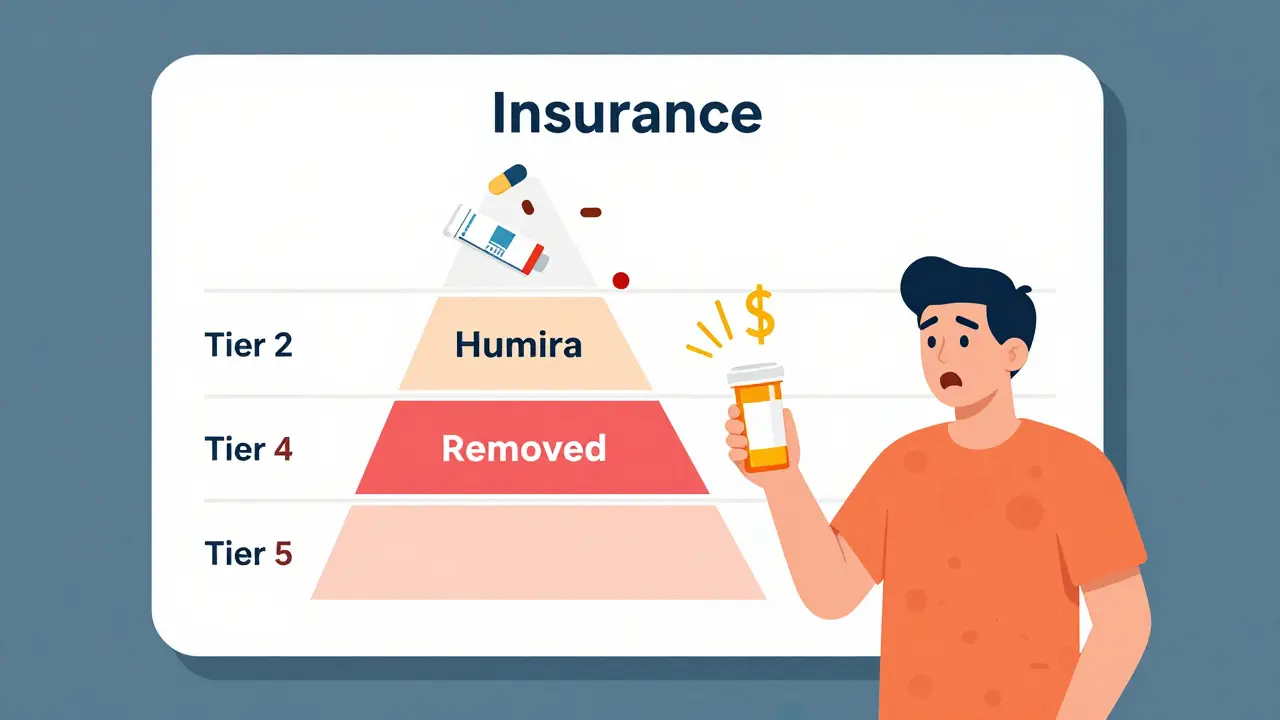

A formulary is the list of drugs your insurance plan will pay for. It’s not random. Every drug on that list has been reviewed by a team of doctors, pharmacists, and cost analysts. They decide which medications are safe, effective, and worth the price. Most plans use a tier system. Tier 1? Usually generic drugs, maybe $5-$15 a month. Tier 2? Brand-name drugs with lower prices - maybe $40. Tier 3 or 4? Higher-cost brands, often $100+. And then there’s Tier 5 - specialty drugs like Humira or Enbrel. Those can cost hundreds, even over $1,000 a month.

Over 90% of Medicare Part D plans and 85% of commercial plans use this tiered system. Why? Because it saves money. Formularies cut pharmacy spending by 12-18% compared to plans with no restrictions. But here’s the catch: when a drug moves up a tier, your bill goes up. When it’s removed entirely, you’re left scrambling.

Why Do Formularies Change?

Formularies aren’t set in stone. They change for a few key reasons:

- New generics hit the market - and they’re cheaper. Your brand-name drug gets pushed to a higher tier to make room.

- A drug’s price spikes. If a manufacturer raises the price too much, the plan drops it to avoid paying more.

- New studies come out. If a drug is found to be less effective or riskier than alternatives, it gets removed.

- Rebates change. Insurance plans get money back from drug makers. If a competitor offers a bigger rebate, your drug gets kicked off.

- Regulations shift. Medicare Part D must cover at least two drugs per category. If one gets pulled, another must be added.

Most large insurers review their formularies every quarter. That means your drug could be removed at any time - even mid-year. And you might not know until you go to refill your prescription.

What Happens When Your Drug Gets Dropped?

Imagine this: You’ve been on Humira for Crohn’s disease for seven years. Your plan suddenly moves it to the highest specialty tier. Your monthly cost goes from $50 to $650. You can’t afford it. You stop taking it. Your symptoms return. You end up in the ER. This isn’t hypothetical. It’s happened to real people - and it’s happening right now.

When a drug is removed from your formulary:

- You get a notice - but only if your plan follows the rules. Medicare plans must give you 30 to 60 days’ notice. Commercial plans? Sometimes as little as 22 days.

- You can request a formulary exception. If your doctor proves you’ll be harmed without the drug, the plan must approve it. About 64% of these requests are approved.

- You can switch to a similar drug. Not always easy. Some conditions have 8 generic options. Others? Only one effective drug exists.

- You can use manufacturer assistance programs. Companies like AbbVie (Humira’s maker) offer co-pay cards or free drug programs for qualifying patients. They covered $6.2 billion in patient costs in 2024.

But here’s the problem: 57% of patients say they get no clear warning before a change. And 41% of Medicare beneficiaries don’t understand how to appeal. That’s not your fault. The system is designed to confuse.

How to Protect Yourself Before It Happens

You can’t stop formulary changes. But you can prepare for them.

- Check your formulary every year during open enrollment. Don’t assume your drug is still covered. Even if it was last year, it might not be this year.

- Use your plan’s online formulary tool. Most insurers have one. Search by drug name, not just brand. Look for tier level and any restrictions - like prior authorization or step therapy.

- Ask your pharmacist. They see formulary changes daily. They know what’s coming.

- Sign up for plan alerts. Many insurers offer email or text notifications when your drug’s status changes.

- Keep a list of your medications, dosages, and why you take them. If you need to appeal, you’ll need this.

Patients who check their formulary before enrollment are 3 times more likely to avoid surprises. Don’t wait until your prescription is denied.

What to Do If Your Drug Is Removed

If your drug is dropped, act fast. You have options.

Option 1: Request a Formulary Exception

This is your strongest tool. Your doctor writes a letter explaining why you need the specific drug - not a substitute. They’ll say things like: “Patient has tried 3 alternatives with no success,” or “This drug is the only one that controls symptoms without severe side effects.”

Medicare plans must respond within 72 hours for urgent cases. For non-urgent, it’s up to 7 days. Keep copies of everything. If denied, you can appeal again - and again.

Option 2: Switch to a Therapeutic Alternative

Not all alternatives are equal. For high blood pressure, there are 8 generic options. For rheumatoid arthritis? Maybe only 2. Talk to your doctor about what’s clinically similar. Don’t just accept the first suggestion. Ask: “Is this as effective? Is it safer for me?”

Some drugs have “therapeutic equivalence” ratings. These mean they work the same way. Your pharmacist can tell you which ones qualify.

Option 3: Use Manufacturer Assistance

Big drug companies have programs to help patients afford their meds. You might get free drugs, co-pay cards, or discounts. These aren’t charity - they’re business. But they work. In 2024, these programs saved patients an average of $3,200 a year on specialty drugs.

Visit the manufacturer’s website or call their patient support line. You’ll need your prescription, insurance info, and proof of income.

Option 4: Get Help from SHIP

If you’re on Medicare, contact your State Health Insurance Assistance Program (SHIP). These free services are run by state governments. They help people understand coverage, file appeals, and find low-cost options. Medicare beneficiaries who use SHIP have a 37% higher success rate with formulary exceptions.

What Providers Should Do

If you’re a doctor or nurse, you’re on the front lines. Your patients depend on you to catch formulary changes before they hurt.

- Use e-prescribing systems that check formulary status in real time. 76% of large medical groups now do this.

- Build a list of preferred alternatives for common drugs your patients take.

- Notify patients 60 days before a change. If your practice gets a formulary update, send a letter or email - don’t wait for the insurer to do it.

- Know your local SHIP office. Refer patients to them. It’s not your job to fix the system - but you can help them navigate it.

The Bigger Picture: Why This System Exists

Formularies aren’t evil. They were created to stop waste. Before formularies, insurers paid for every drug - no matter how expensive or ineffective. Now, they steer patients toward better value. A 2024 study found value-based formularies - those that consider long-term outcomes, not just price - cut total healthcare costs by 9-14% while keeping patients healthier.

But the system has become too focused on cost. When a drug moves from tier 2 to tier 3, abandonment rates jump 47%. For diabetes drugs? It’s 58%. People stop taking their meds because they can’t afford them. That leads to hospitalizations, complications, and higher costs down the line.

The real problem isn’t formularies. It’s lack of transparency. Only 22% of patients understand how decisions are made. That’s unacceptable.

What’s Changing in 2025 and Beyond

Things are shifting. The Inflation Reduction Act caps out-of-pocket drug costs for Medicare beneficiaries at $2,000 a year starting in 2025. That’s huge. It means insurers can’t push patients to the edge anymore. They’ll have to design formularies differently - maybe with fewer high-tier drugs.

Also, AI tools are now predicting which formulary changes will cause patients to stop taking their meds - with 89% accuracy. Insurers are starting to use this to avoid harmful changes before they happen.

And in the next 10 years, we may see personalized formularies - ones based on your genetics, past response to drugs, and even your lifestyle. That could mean better outcomes and fewer surprises.

For now, though, the system is still confusing, slow, and unfair. But you’re not powerless. Know your rights. Check your formulary. Ask questions. Use the tools. And if you’re denied - fight back. You’ve got more leverage than you think.

What should I do if my insurance stops covering my medication?

First, don’t stop taking your medication. Contact your doctor and your insurance plan immediately. Ask for a formulary exception - your doctor can submit a letter explaining why you need the drug. You can also check if the manufacturer offers patient assistance programs. If you’re on Medicare, call your State Health Insurance Assistance Program (SHIP) for free help with appeals.

How much notice should I get before a formulary change?

Medicare Part D plans must give you 30 to 60 days’ notice for non-urgent changes. Commercial plans are not required to give as much - some only give 22 days. Always check your plan’s member handbook. If you don’t get notice, you still have the right to request a formulary exception or a transition supply.

Can I switch to a generic version if my brand-name drug is dropped?

Sometimes, yes - but not always. For conditions like high blood pressure or depression, generics often work just as well. But for autoimmune diseases, cancer, or rare conditions, there may be no effective generic. Talk to your doctor before switching. Never assume a generic is safe or effective without medical advice.

Why do formulary changes happen so suddenly?

Formularies are reviewed quarterly, and changes can be made quickly if a drug’s price spikes, a new generic enters the market, or a rebate deal ends. Insurance plans aren’t required to give long notice - especially commercial ones. The system prioritizes cost savings over patient communication, which is why it feels sudden. Proactive patients check their formulary every year and stay alert.

Are there any drugs that can’t be removed from a formulary?

Medicare Part D plans must cover at least two drugs in each therapeutic class. But they can still remove one if they add another. No drug is guaranteed permanent coverage. Even life-saving drugs can be moved to higher tiers or require prior authorization. The only protection is your right to appeal if a change harms your health.

jonathan soba

January 29, 2026 AT 07:51Let’s be real - formularies are just corporate cost-shifting dressed up as ‘value-based care.’ The real scandal? Pharma pays insurers billions in rebates to favor their drugs, and patients get stuck with the bill when the rebate deal expires. No transparency, no accountability. Just profit math with lives as the variable.

And don’t get me started on ‘step therapy.’ I’ve seen people with MS wait 6 weeks to get approved for a drug that works - while their condition deteriorates. The system doesn’t care if you live or die. It cares if your drug’s rebate is higher than the alternative’s.

They call it ‘managed care.’ I call it managed neglect.

Chris Urdilas

January 31, 2026 AT 07:01So let me get this straight - you’re telling me my insurance can yank my $40/month drug and make me pay $600 overnight… but if I call them, they’ll act like I’m asking for a free vacation?

Meanwhile, the CEO of my insurer just bought a private island. Coincidence? I think not.

Also - ‘formulary exception’? That’s just a polite way of saying ‘hope your doctor has a death wish and a printer.’

Also also - why do we still pretend this is healthcare and not a casino where the house always wins?

Phil Davis

February 1, 2026 AT 01:02I used to work in pharmacy benefits management. Saw the inner workings. The truth? Formularies aren’t about clinical outcomes. They’re about rebate maximization.

Drug X and Drug Y are identical in efficacy. But Drug X gives the plan a 20% rebate. Drug Y? 5%. Guess which one gets tier 1?

Doctors don’t even know half the time. They just prescribe what’s in the system. Patients get collateral damage.

It’s not broken. It’s designed this way.

Irebami Soyinka

February 2, 2026 AT 08:03USA you still think this is normal? 😒 In Nigeria, if you can’t afford your meds, you go to the local herbalist - and they don’t charge you $500 for a pill that’s been around since 1998.

Here you got billionaires making billions off people’s diabetes, and the government lets them get away with it. 🤡

They call it ‘innovation.’ I call it robbery with a prescription pad.

Someone please tell me why we still have insurance companies as middlemen? 🙄

Healthcare should be a right, not a luxury you win like a lottery ticket. #NaijaStrong

Mel MJPS

February 4, 2026 AT 07:02I’ve been on Humira for 10 years. Last year, my plan dropped it. I panicked. Called my doctor. She helped me file an exception - took 3 weeks, but it worked.

Also used AbbVie’s co-pay card - saved me $400/month.

And yes, I check my formulary every December like clockwork. It’s annoying, but it’s saved me from disaster twice.

If you’re reading this and scared - you’re not alone. But you’ve got tools. Use them. You’re stronger than the system thinks.

Katie Mccreary

February 5, 2026 AT 14:35Why are people still surprised by this? You think your insurance cares if you live? They’re a corporation. Their job is to make money. You’re a line item.

Stop blaming the system. Stop asking nicely. Start fighting. File appeals. Call your reps. Tweet at the CEO. They hate the noise. Make them hear it.

SRI GUNTORO

February 7, 2026 AT 01:39People who don’t check their formulary every year deserve what they get. This isn’t complicated. If you’re on a chronic medication, you should be treating your insurance plan like a toxic ex - check their moves, don’t trust them, and always have a backup plan.

It’s not the system’s fault. It’s yours for being lazy.

Rose Palmer

February 8, 2026 AT 21:49As a healthcare professional, I want to emphasize that proactive patient engagement is the single most effective strategy against formulary disruption.

Patients who maintain a current medication list, understand tier structures, and establish communication with their pharmacist reduce adverse outcomes by over 60%.

I recommend scheduling a quarterly review with your provider - even if nothing has changed. Prevention is always preferable to crisis management.

Additionally, SHIP counselors are trained to navigate these complexities. No patient should face this alone.

Mindee Coulter

February 9, 2026 AT 19:32Rhiannon Bosse

February 11, 2026 AT 06:16Okay but have you heard about the secret algorithm? 🤫

Big Pharma and insurers have a secret AI that predicts which patients are most likely to die if their drug gets pulled - and then they target THOSE drugs for removal first. Why? Because then they can sell you a ‘new and improved’ version next year at 3x the price.

It’s not conspiracy. It’s in the patent filings. I read the docs.

They’re not just greedy. They’re *calculating*. And they’re watching you right now.

Change your password. Delete your insurance app. Burn your EOBs. They’re tracking you.

They know you take Humira.

They know you can’t afford it.

And they’re laughing.

Bryan Fracchia

February 11, 2026 AT 20:13It’s wild, isn’t it? We’ve built a system where the cure for your illness is also the thing that bankrupts you.

And yet - we keep acting like this is normal.

Maybe the real question isn’t how to navigate formularies - but why we let corporations decide who gets to live.

What if we treated healthcare like a public good instead of a profit center?

Just a thought.