Annual Savings from FDA Generic Drug Approvals: Year-by-Year Breakdown

Dec, 7 2025

Dec, 7 2025

Every year, the U.S. Food and Drug Administration (FDA) approves hundreds of generic drugs - and each approval saves billions. But the numbers aren’t steady. Some years, savings spike. Others, they drop. Why? It’s not random. It’s tied to which brand-name drugs lose patent protection and how big their markets are.

What the Numbers Actually Mean

When people talk about savings from generic drugs, they’re usually mixing two different numbers. One comes from the FDA. The other from the Association for Accessible Medicines (AAM). They’re both right - but they measure different things.

The FDA tracks savings from new generic approvals in a single year. That means: if a drug like Lipitor or Humira loses its patent and a generic version hits the market, the FDA calculates how much money was saved in the first 12 months after that generic launched. This includes two parts: the drop in price for the generic itself, and the price cut the brand-name company had to make to stay competitive.

The AAM looks at the total savings from every generic drug being used that year. That’s the full picture: all generics, all brands, all prescriptions. It’s like comparing the cost of a single new car purchase versus the total you spent on cars over the last decade.

So if you see a headline saying ‘$7 billion saved in 2019,’ that’s the FDA’s number - just from new generics that year. But the AAM says Americans saved $408 billion in 2022 just from using generics overall. That’s the real scale.

Year-by-Year Breakdown: FDA Data (New Generic Approvals)

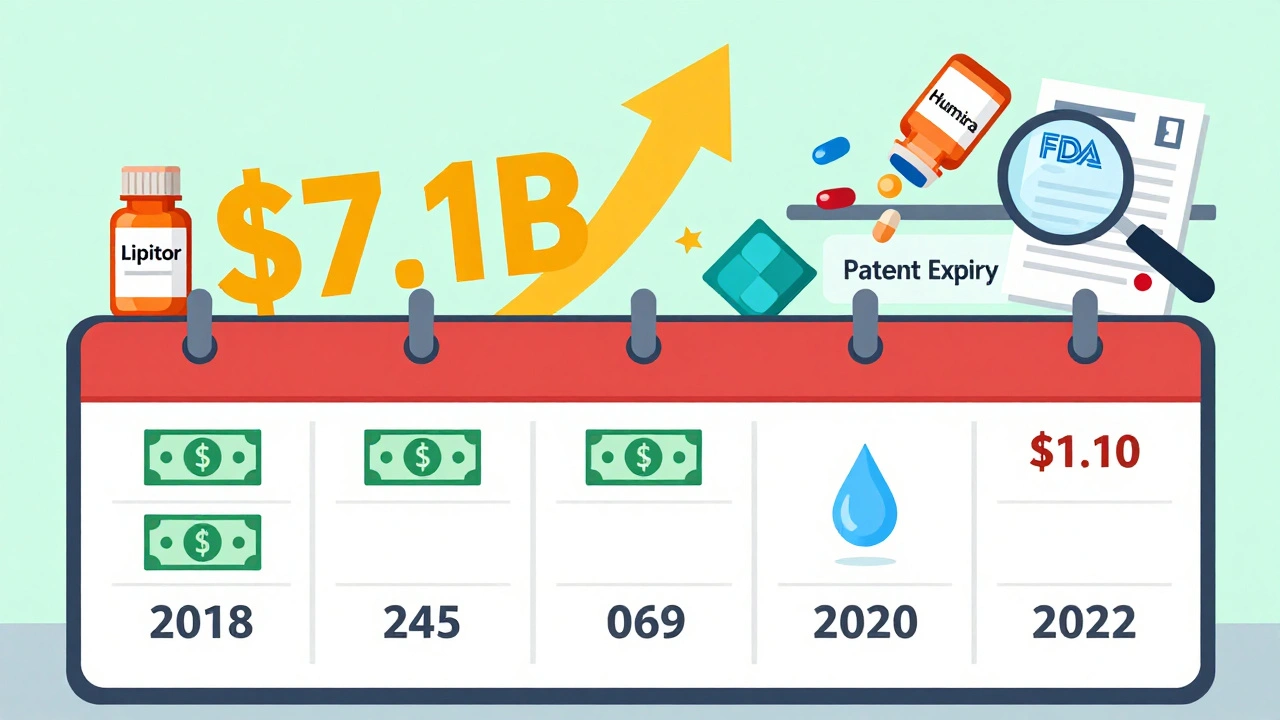

Here’s what the FDA recorded for savings from new generic approvals, year by year:

- 2018: $2.7 billion

- 2019: $7.1 billion - the highest in over a decade

- 2020: $1.1 billion

- 2021: $1.37 billion

- 2022: $5.2 billion

Why the wild swings? It’s all about the drugs. In 2019, several high-cost brand-name drugs lost patent protection at once - including a major cholesterol med and a diabetes drug. That’s when savings jumped. In 2020, fewer big drugs went generic. So savings dropped - even though the FDA approved the same number of generics.

2022 saw another spike. Why? Five new generics hit markets worth over $1 billion each. One of them was for a blood thinner used by millions. That single drug accounted for nearly $1.5 billion in savings in its first year. That’s more than the entire savings total for 2020.

And here’s the kicker: about half of all first-generic savings in 2021 came from just five drugs. That’s not an accident. It’s the nature of the market. Big drugs = big savings. Small drugs = small savings. But the small ones add up.

Total Generic Savings: What the AAM Reports

While the FDA tracks new entries, the AAM tracks the full impact. And that’s where the real story is.

- 2020: $338 billion saved

- 2022: $408 billion saved

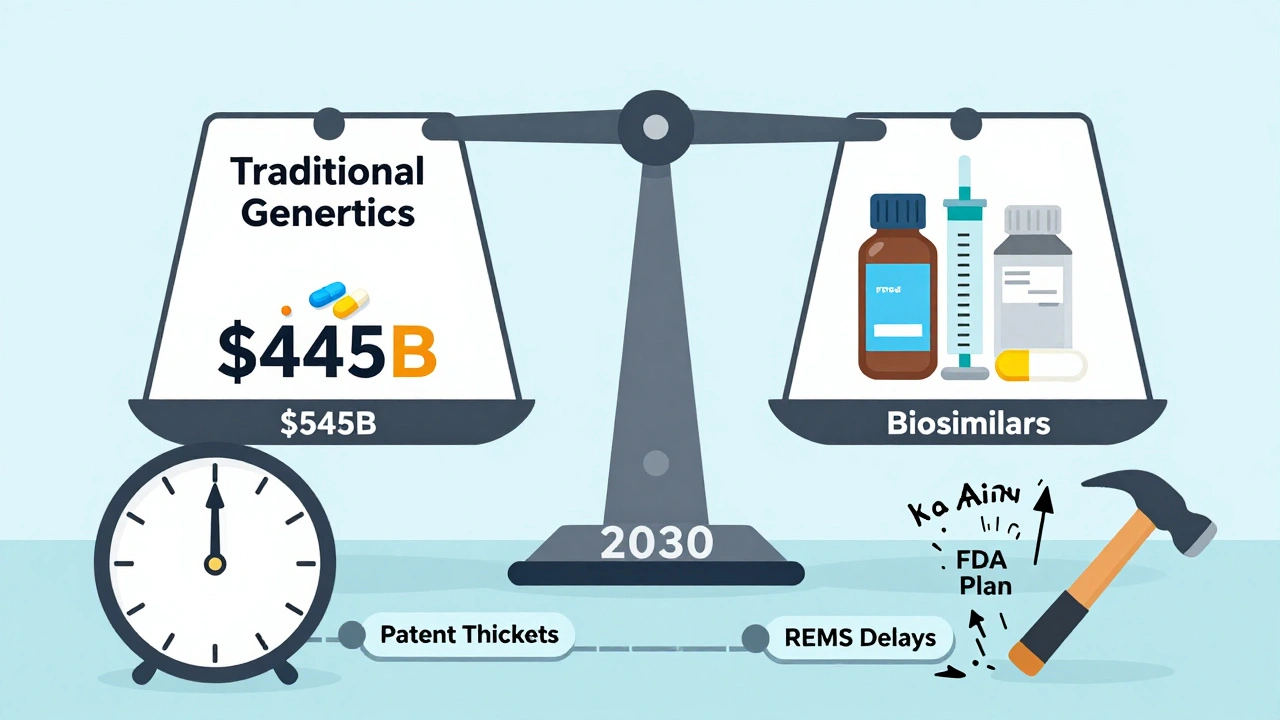

- 2023: $445 billion saved

That’s $445 billion in one year - just from generics. To put that in perspective, that’s more than the entire annual budget of the U.S. Department of Education. It’s also more than the GDP of countries like Denmark or New Zealand.

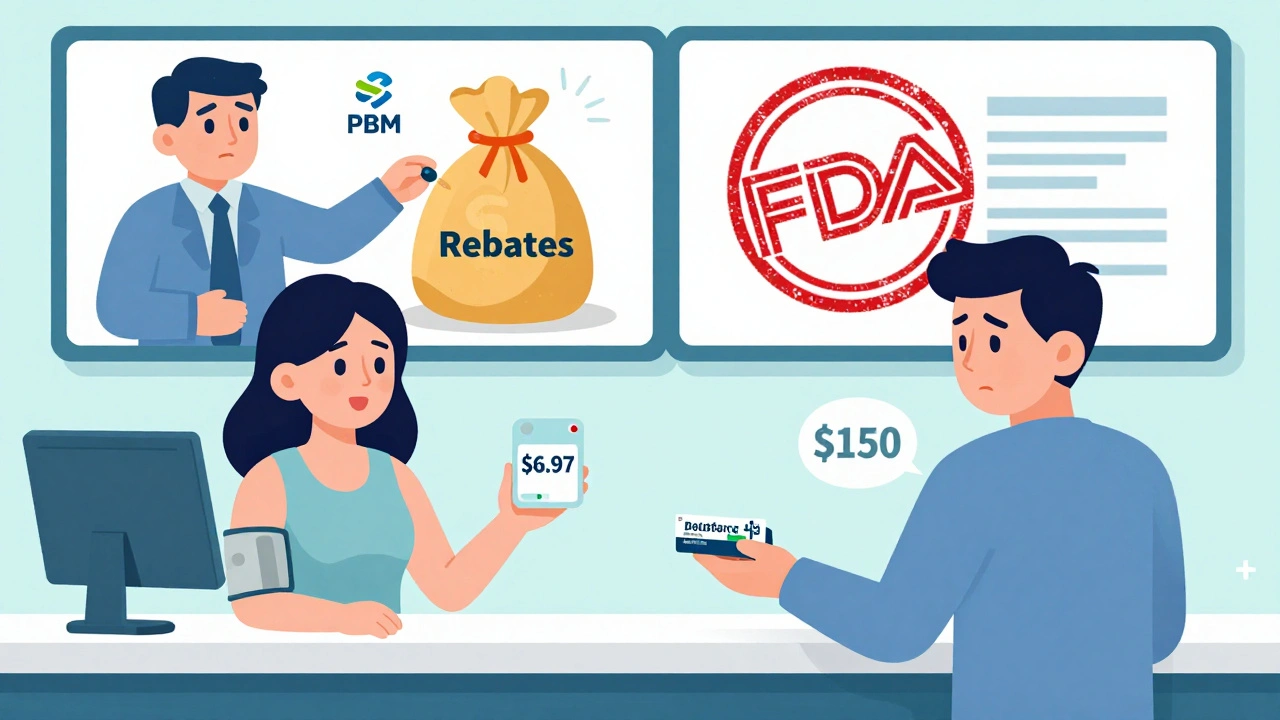

Who benefits? Medicare saved $137 billion in 2023 - that’s $2,672 per beneficiary. Commercial insurers saved $206 billion. Medicaid saved the rest. For patients, it means a 30-day supply of a generic blood pressure pill costs $6.97 on average. The brand version? Often $150 or more.

Therapeutic areas show the biggest wins:

- Heart disease: $118.1 billion saved

- Mental health: $76.4 billion saved

- Cancer: $25.5 billion saved

These aren’t theoretical numbers. They’re prescriptions filled. Copays paid. Lives changed.

How the FDA Calculates Savings

The FDA doesn’t guess. They use real sales data. For every new generic approved, they track prices and volumes for 12 months. The formula is simple:

Savings = (Brand price - Generic price) × Generic volume + (Brand price drop × Brand volume)

Example: A brand-name drug sells for $200 a month. A generic hits at $40. 1 million people switch. That’s $160 × 1 million = $160 million saved. But the brand company, seeing sales drop, cuts its price to $120 to keep some customers. The remaining 200,000 people who still buy the brand now pay $80 less each. That’s another $16 million saved. Total: $176 million.

They only track 384 out of 408 unique drugs in a typical year - because not all manufacturers report data. But the sample is large enough to be accurate.

Who Gets the Savings? Not Always the Patient

Here’s the ugly truth: just because a drug gets cheaper doesn’t mean the patient pays less.

Pharmacy benefit managers (PBMs) - middlemen between insurers, pharmacies, and drugmakers - collect rebates. In 2023, a Senate investigation found only 50-70% of generic savings actually reached patients. The rest stayed with PBMs and insurers.

Patients on Medicaid or Medicare often see the full benefit. But those with private insurance? Their copays don’t always drop - even when the drug’s list price does. Why? PBMs negotiate deals with drugmakers that don’t always pass savings to consumers.

That’s why a pharmacist in Ohio might tell you: ‘I fill 92% of generic prescriptions for under $20.’ But a patient in Texas might still pay $50 for the same pill because their plan’s formulary doesn’t reflect the lower cost.

Why This Matters for the Future

Generics now make up 90% of all prescriptions in the U.S. But they cost only 13.1% of total drug spending. That’s the power of competition.

But the low-hanging fruit is gone. The easy wins - blockbuster drugs like Lipitor and Plavix - already went generic. Now, the FDA is approving more complex generics: injectables, inhalers, patches. These take longer to develop. They’re harder to copy. That means fewer big savings in the near term.

Biosimilars - generic versions of biologic drugs like Humira - are the next frontier. As of August 2024, the FDA has approved 59 biosimilars. But so far, their savings are modest. Why? High development costs and legal delays from brand companies.

Still, the trend is clear: generics are the backbone of affordable care. Without them, millions would skip doses. Hospitals would be overwhelmed. Medicare would break.

What’s Next?

The FDA’s 2023 Drug Competition Action Plan is pushing to remove barriers that delay generic entry - like REMS programs that block access to brand samples for testing, or patent thickets that stretch exclusivity beyond legal limits.

By 2030, experts project annual generic savings could hit $500 billion. But that depends on policy, competition, and whether the system actually passes savings to patients - not just corporations.

For now, the data is undeniable: every time a generic drug gets approved, it saves billions. The question isn’t whether generics work. It’s whether we’re letting them work as fast and fairly as they should.

How much do generic drugs save the average American each year?

The average American saved about $1,300 in 2023 just from using generic drugs. This comes from lower copays, reduced insurance premiums, and lower overall drug spending. For Medicare beneficiaries, the average savings was $2,672 per person.

Why do generic drug savings vary so much from year to year?

Savings spike when high-cost brand-name drugs lose patent protection. In 2019, several multi-billion-dollar drugs went generic at once, pushing savings to $7.1 billion. In 2020, fewer big drugs expired, so savings dropped to $1.1 billion. It’s not about how many generics are approved - it’s about how expensive the drugs are that they replace.

Do generic drugs work as well as brand-name drugs?

Yes. The FDA requires generics to have the same active ingredient, strength, dosage form, and route of administration as the brand. They must also be bioequivalent - meaning they work the same way in the body. Over 90% of prescriptions filled in the U.S. are generics, and they’re used safely every day.

Why aren’t generic drug prices always lower at the pharmacy?

Pharmacy benefit managers (PBMs) often negotiate rebates with drugmakers that don’t get passed to patients. Even if a drug’s list price drops, your copay might not change. Some states have passed laws to force transparency, but nationwide reform is still pending.

Are biosimilars saving as much as traditional generics?

Not yet. Biosimilars - generic versions of complex biologic drugs - cost less than brands, but not as much as traditional generics. They’re expensive to develop and face legal delays from brand manufacturers. As of 2024, only 59 have been approved. Savings are growing, but they’re still a small fraction of the $445 billion saved by traditional generics in 2023.

How does the FDA speed up generic approvals?

The FDA uses the Generic Drug User Fee Amendments (GDUFA), which lets drugmakers pay fees to fund faster reviews. Since GDUFA started, 95% of standard generic applications are reviewed within 10 months - down from over 2 years in the early 2000s. This helps generics reach the market faster, increasing competition and savings.

Anna Roh

December 8, 2025 AT 02:12So basically the system saves billions but patients still pay too much? Cool. I’ll just keep skipping my meds then.

om guru

December 8, 2025 AT 21:06Generic drugs are essential for equitable healthcare access. The data demonstrates systemic efficiency. Savings must be passed to end users without intermediaries capturing value.

Delaine Kiara

December 10, 2025 AT 06:09Oh wow so the FDA is just playing favorites with drug patents?? And PBMs are literally stealing from sick people?? I knew it. I KNEW IT. This is why my insulin costs $400 even though the generic is $12. Someone’s got a yacht. Someone’s got a private island. And I’ve got a 30-day supply of metformin that feels like a luxury.

And don’t even get me started on how the brand companies drag their feet for 17 years on patents like it’s a Netflix binge. I swear if I see one more ‘patent thicket’ I’m gonna scream into a pillow made of expired prescriptions.

And biosimilars?? They’re basically the awkward cousin at Thanksgiving - expensive, complicated, and nobody wants to talk about them. But we gotta. Because my aunt with rheumatoid arthritis can’t afford Humira and her doctor says ‘try the biosimilar’ but the insurance won’t cover it unless she files a 12-page form and cries in triplicate.

Also - why is it that when a drug goes generic, the pharmacy still charges me $50 but the label says $7? Who’s the magician here? Is it the PBM? The pharmacist? The ghost of Big Pharma’s CFO? I need answers. And maybe a new doctor.

And what’s with the 50-70% savings actually reaching patients? That’s like saying ‘I won the lottery but only got to keep half the money’ and then the lottery guy says ‘sorry, that’s how the system works.’

And don’t even get me started on how Medicare gets the full benefit but private insurance? Nah. That’s like saying ‘everyone gets free pizza’ but only if you’re on the guest list and you know the bouncer.

I’m not mad. I’m just… disappointed. Like, emotionally exhausted disappointed. Like I just watched three seasons of House MD and realized the show was right all along - the system is broken. And we’re all just patients in a giant, overpriced waiting room.

Also - why is no one talking about how the FDA only tracks 384 out of 408 drugs? That’s like saying ‘we counted 384 stars in the sky’ and ignoring the rest because ‘it’s too hard.’

And the fact that half of 2021’s savings came from five drugs? That’s not innovation. That’s just gambling on which drug’s patent is gonna expire next. Like a drug roulette wheel. And we’re all just sitting there holding our wallets.

Someone needs to burn it all down. Or at least pass a law that says ‘if the drug price drops, your copay drops too.’ Simple. Human. Fair.

And if you’re reading this and you’re a PBM exec - I’m not yelling at you. I’m just… watching. And taking notes. With a pen made of grief.

Darcie Streeter-Oxland

December 11, 2025 AT 13:43It is evident that the disparity between aggregate savings and patient-level benefits constitutes a critical policy failure. The structural role of pharmacy benefit managers necessitates immediate regulatory intervention to ensure cost reductions are transmitted to end-users.

Andrea Petrov

December 13, 2025 AT 08:17Did you know the FDA gets pressure from lobbyists to delay generics? I mean, seriously - the same people who funded your senator’s campaign are the ones who own the brand-name companies. That’s why 2020 was such a low year. No big drugs expired… because they were *protected*. And don’t even get me started on REMS - those aren’t safety programs, they’re legal traps. The FDA doesn’t want to fight this. They’re scared. And the public? They’re too busy scrolling TikTok to care.

And biosimilars? Ha. They’re just the next phase of corporate greed. Same playbook. Same lawyers. Same delays. It’s all a show. You think the $445 billion is real? Maybe. But half of it went to shareholders. Not patients. Not hospitals. Not pharmacies. Just the people who already had too much.

And you know what’s worse? The fact that your copay didn’t drop even though the drug cost 80% less? That’s not a glitch. That’s the design. They want you to keep paying. Because if you stop, they lose control.

And the ‘average American saved $1,300’? Cute. That’s not real for the 40% of people who can’t afford to fill their prescriptions at all. You don’t save money if you don’t get the drug. So what’s the point of the headline? To make people feel good while their kidneys fail?

They’re not fixing the system. They’re just making the numbers look better.

Haley P Law

December 13, 2025 AT 08:20okay but like… WHY IS MY COPAY STILL $50 FOR A DRUG THAT COSTS $6?? 😭 I fill this prescription every month and I swear the pharmacist looks at me like I’m the problem. I’m not asking for a vacation. I’m asking for my $40 back. 💸 #GenericDrugScam #PBMsAreVampires

Andrea DeWinter

December 13, 2025 AT 11:01Generics are the unsung heroes of American healthcare. Most people don’t realize that without them, we’d be paying triple for every pill - and millions would go without. The real story isn’t the big spikes in 2019 or 2022 - it’s the quiet, daily savings. That $6 blood pressure pill? That’s someone choosing between groceries and meds. That’s someone keeping their job. That’s someone living.

Yes, PBMs are a mess. Yes, the system is broken. But the solution isn’t to give up on generics - it’s to fix the middlemen. Demand transparency. Push for laws that require copays to reflect actual drug costs. Talk to your reps. Write to your insurer. This isn’t just about money - it’s about dignity.

And biosimilars? They’re coming. Slowly. But they’re coming. And when they finally hit their stride, we’ll see even bigger savings. Just not today. Not yet. But it’s happening.

Keep taking your generics. And keep asking why you’re still paying too much. Because the system only changes when we make it.

Steve Sullivan

December 15, 2025 AT 06:38so like… the whole thing is just capitalism with a stethoscope?? 🤔

we got these miracle drugs that save billions but the people who need them the most? they’re still paying like it’s 2005. and the middlemen? they’re just… taking the difference like it’s a tip. like ‘oh you saved $100 on this pill? cool, here’s $30 for me.’

and the FDA? they’re trying. but they’re stuck between pharma giants and bureaucrats who think ‘efficiency’ means ‘more paperwork.’

and biosimilars? they’re the future. but right now they’re like that one friend who’s super smart but always late to the party.

we need to stop celebrating the numbers and start fixing the pipeline. because saving $445 billion means nothing if your neighbor’s skipping insulin to pay rent.

also… why does every comment about this feel like a TED Talk? can we just be mad? i’m just… mad. 😤

George Taylor

December 15, 2025 AT 08:21And yet… the FDA only tracks 384 out of 408 drugs? That’s not oversight - that’s negligence. And you call this ‘accurate’? No. It’s a lie by omission. And the AAM? They’re just happy to throw around $445 billion like it’s Monopoly money. But where’s the breakdown by income? By state? By race? You think low-income patients in Mississippi are saving $1,300? No. They’re saving $0 - because they never filled the prescription. The system doesn’t care. It only cares about the headline. The headline is what gets the grant. The headline is what gets the press. The headline is what keeps the FDA looking good. But the people? They’re just numbers in a spreadsheet. And when the numbers drop in 2020? They shrug. ‘Fewer big drugs expired.’ Like that’s an excuse. Like that’s not people dying because they couldn’t afford the brand. And the PBMs? They’re not just profiting - they’re orchestrating this. They’re the ones who control the formularies. They’re the ones who decide what’s ‘preferred.’ And you think they care if you can afford it? No. They care if the rebate check clears. That’s it. That’s the whole game.

And you know what’s worse? That you’re reading this and you’re still not doing anything. You’re just scrolling. Just nodding. Just saying ‘yeah, that’s messed up.’ And then you go back to your $50 copay. And you don’t call your rep. You don’t write to your insurer. You don’t even complain to the pharmacist. You just accept it. And that’s the real tragedy. Not the numbers. Not the patents. Not even the PBMs. It’s that we’ve learned to live with it.

Carina M

December 16, 2025 AT 04:49It is profoundly irresponsible to suggest that generic drug savings are equitably distributed. The current regulatory and reimbursement architecture systematically disadvantages low-income populations. The FDA’s metrics are statistically sound but ethically hollow. Without mandatory pass-through provisions for rebates, the entire framework is a performative illusion of accessibility.

Ajit Kumar Singh

December 16, 2025 AT 12:36India makes 20% of all generic drugs used in US. We know how to make them cheap. We know how to make them good. But US system is broken. PBMs take money. Pharma lobby blocks. Patients suffer. We need global supply chain not just US politics. India is ready. Why not let us help?

Maria Elisha

December 18, 2025 AT 00:51so like… i just got my generic metformin for $4 at walmart. but my friend pays $45 for the same thing. why???

Angela R. Cartes

December 19, 2025 AT 04:26It’s almost poetic, isn’t it? The very drugs that keep millions alive are now the subject of a corporate ballet - choreographed by lawyers, funded by lobbyists, and performed on the backs of diabetic grandmothers and asthmatic teens. The FDA’s numbers are elegant. The AAM’s are majestic. But the reality? It’s a broken vending machine that takes your dollar and spits out a pill… and a receipt you can’t read.

And don’t even get me started on how ‘bioequivalent’ doesn’t mean ‘identical experience.’ I’ve been on two different generics for the same drug - one gave me migraines. The other? I felt like a new person. But the system doesn’t care about that. It only cares about the lab results. The body? It’s just a variable.

And yet… we still call this progress.

Steve Sullivan

December 20, 2025 AT 14:01wait so if the FDA only tracks 384 out of 408… what happened to the other 24? did they just… vanish? like a magic trick? ‘poof! no savings here, move along!’

and also… why is the PBM rebate system still a secret? like… if i buy a toaster and the store says ‘we got a $20 rebate from the manufacturer’ but i still pay full price… i’d be furious. why is this any different?

also… i just realized the FDA’s formula is basically ‘how much did we trick the brand into lowering their price?’… that’s not a savings metric. that’s a negotiation win.

we need a new metric. ‘how much did the patient actually pay?’